Calculating Whole Month Threshold Proration

When using the Use Whole Month Threshold proration calculation, Billing Central calculates how many whole months are in the partial period, then:

- If the remainder is 16 days or more, it is charged as a whole month.

- If the remainder is less than 16 days, no charge is made for those days.

The formula used to calculate the prorated value for the partial period is:

Sales Price * ((W+R)/Z)

where:

- W is the number of days in the partial period / 30.4 rounded down to a whole number. This calculates the number of whole months in the partial period.

- R is either of the following:

1 if the remainder from W is equal to or greater than 16

0 if the remainder from W is less than 16 - Z is the number of months in the full period.

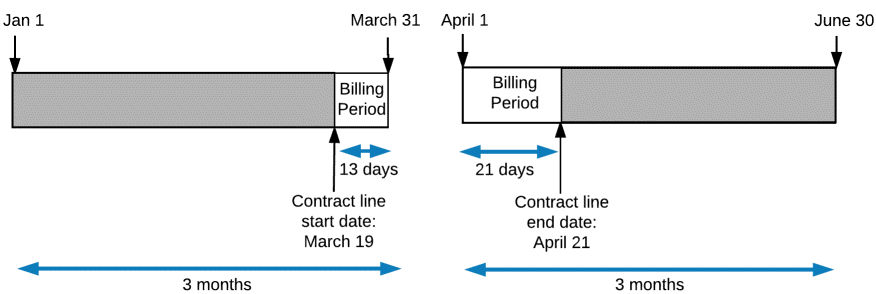

Example 1

|

Line Start Date |

Line End Date |

Billing Term |

Line Sales Price |

First Billing Period |

Final Billing Period |

|---|---|---|---|---|---|

| Sun, March 19, 2017 | Fri, April 21, 2017 | QB | $90 |

March 19 to March 31 = 13 days W = 13/30.4 rounded down to a whole number = 0 with 13 remainder 13 < 16 so R = 0 Jan 1 to March 31 = 3 months $90 * (0/3) = $0 |

April 1 to April 21 = 21 days W = 21/30.4 rounded down to a whole number = 0 with 21 remainder 21 > 16 so R = 1 April 1 to June 30 = 3 months $90 * (1/3) = $30 |

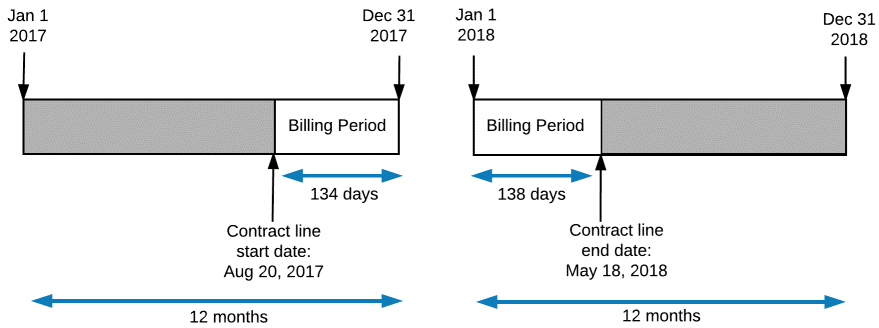

Example 2

|

Line Start Date |

Line End Date |

Billing Term |

Line Sales Price |

First Billing Period |

Final Billing Period |

|---|---|---|---|---|---|

| Sun, Aug 20, 2017 | Fri, May 18, 2018 | YB | $120 |

Aug 20 to Dec 31 = 134 days W = 134/30.4 rounded down to a whole number = 4 with 12.4 remainder 12.4 < 16 so R = 0 Jan 1 to Dec 31 = 12 months $120 * (4/12) = $40 |

Jan 1 to May 18 = 138 days W = 138/30.4 rounded down to a whole number = 4 with 16.4 remainder 16.4 > 16 so R = 1 Jan 1 to Dec 31 = 12 months $120 * (5/12) = $50

|

View Tutorial

View Tutorial