Retrieving Outstanding Transactions

To retrieve the outstanding transactions from the Cash Matching page:

- Navigate to the Cash Matching page.

- Click Select Account. The Select Account window displays a grid with the following columns:

- Account Name

- Account Number

- Account Type

- Dimensions

- Select an account that you want to match.

- Click Next and select the currency for the match.

- Click Retrieve to close the dialog and display the outstanding transactions and cash entries for the account you selected.

To retrieve the outstanding transactions from the account detail page:

- Navigate to the detail page for the account for which you have unmatched cash entries.

- Click the Cash Matching button to open the Cash Matching page. If you can't see this button, contact your administrator.

Finding Transactions

To learn more about finding specific transactions in the user interface, see Finding Transactions.

Matching Transactions

The Cash Matching page enables you to match cash entries against outstanding sales or payable invoices, credit notes and journals.

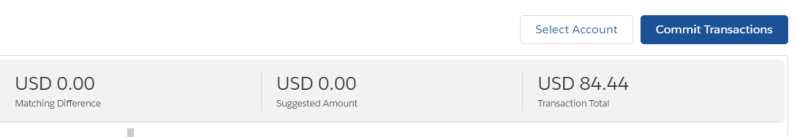

For a simple match, select a combination of two or more associated credit and debit transactions that sum to zero in the Matching Difference. Each time you select a line its outstanding value is added to the totals according to the type of line. Cash entry lines values are added to the Cash Entries Total and transaction lines are added to the Transaction Total.

The Match Difference field displays the current difference of value between the Cash Entries Total and the Transaction Total to help you find a matching combination. You do not need to do anything else for a simple match.

available for matching

available for matching

selected for matching

selected for matching

Part-Payments

For a match that includes a part-payment, when you have selected the transactions you want to match, amend the values in the Paid column in the Transactions grid, until the Match Difference displays zero.

Overpayments

For a match that includes an overpayment, when you have selected the transactions you want to match, amend the values in the Paid column in the Cash Entries grid, until the Match Difference displays zero.

Settlement Discounts

For a match that includes settlement discounts, when you have selected the transactions you want to match, the paid and discount values are updated automatically, according to the currency mode, the discount date and the credit terms Set of terms used to determine due dates and discounts for the goods and services bought or sold. Terms can be set at account level for vendors and/or company level for customers. in force when the document was posted. You can, if you wish, amend the amounts paid and the values of any discounts in the Paid and Discount columns in the Transactions grid, until the Match Total displays zero. If you can't see a Discount column, contact your administrator.

Set of terms used to determine due dates and discounts for the goods and services bought or sold. Terms can be set at account level for vendors and/or company level for customers. in force when the document was posted. You can, if you wish, amend the amounts paid and the values of any discounts in the Paid and Discount columns in the Transactions grid, until the Match Total displays zero. If you can't see a Discount column, contact your administrator.

Write Offs

For a match that includes values to write off, when you have selected the transactions you want to match, enter the actual amounts paid and the values of any write-offs into the Paid and Write-off columns respectively in the Other Transactions grid, until the match total displays zero. If you can't see a Write-off column, contact your administrator.

Committing a Match

When you reach a Match Difference of 0.00, click Commit Transactions to review and amend the journal details as necessary. To finish, click Commit. See About Cash Matching for more information about what happens when you commit a match.

If successful, details are displayed along with a new cash matching reference in the Matched tab.

- To continue matching, click Select Account again.

- To conclude the matching session, choose another tab.

Using Classic

Using Classic

Retrieving Outstanding Transactions

To retrieve outstanding transactions for an account:

- Do one of the following steps to display the Cash Matching page:

- Navigate to the detail page for the account for which you have unmatched cash entries and click the Cash Matching button. If you can't see this button, contact your administrator.

- Or, click the Cash Matching tab.

- If the Account field is blank, select the account you want to match. This can be any type of account. If it is an intercompany account, it cannot be the one that represents your current company.

- [Optional] Add further analysis dimensions

Custom objects that allow you to analyze the activity in your business in additional ways, such as by cost center, project, employee, or any other business entity important to you. to the account, click the expander icon to display an Analysis panel.

Custom objects that allow you to analyze the activity in your business in additional ways, such as by cost center, project, employee, or any other business entity important to you. to the account, click the expander icon to display an Analysis panel.The currency mode defaults to the value defined on the company

A self-balancing accounting unit within your organization. details, but you can change it here. In account mode, matching takes place in account currency. In document mode, you must select a matching currency.

A self-balancing accounting unit within your organization. details, but you can change it here. In account mode, matching takes place in account currency. In document mode, you must select a matching currency. - [Optional] Amend the default matching date. This date is applied to any cash matching journals created by the match.

- [Optional] For a match that includes settlement discounts, amend the default discount date.

- [Optional] In the Analysis section, view or edit the default general ledger accounts for settlement discounts, write-offs and currency write-offs. The defaults are those specified for accounts receivable on the company record.

- [Optional] View or edit the default analysis dimensions associated with the general ledger accounts.

- Click Retrieve.

Transactions with a status of "Available" for the selected account are retrieved. All values are entered and displayed in match currency. They are displayed in two grids: one for transactions of type "Cash" and the other for transactions originating from the other document types.

The header details are hidden when transactions are retrieved. If at any time you want to see them again, click Show Header Details.

Finding Transactions

To learn more about finding specific transactions in the user interface, see Finding Transactions.

Matching Transactions

To match cash entries against outstanding sales or payable invoices, credit notes and journals:

For a simple match, select a combination of two or more associated credit and debit transactions that sum to zero. Each time you select a line its outstanding value is copied into the Paid column. You do not need to do anything else for a simple match.

available for matching

available for matching

selected for matching

selected for matching

The Match Total field displays the current sum of selected values in the Paid columns to help you find a matching combination.

For a match that includes a part-payment

For a match that includes a part-paymentWhen you have selected the transactions you want to match, amend the values in the Paid column in the Other Transactions grid, until the Match Total displays zero.

For a match that includes an overpayment

For a match that includes an overpaymentWhen you have selected the transactions you want to match, amend the values in the Paid column in the Cash Entries grid, until the Match Total displays zero.

For a match that includes settlement discounts

For a match that includes settlement discountsWhen you have selected the transactions you want to match, the paid and discount values are updated automatically, according to the currency mode, the discount date and the credit terms Set of terms used to determine due dates and discounts for the goods and services bought or sold. Terms can be set at account level for vendors and/or company level for customers. in force when the document was posted. You can, if you wish, amend the amounts paid and the values of any discounts in the Paid and Discount columns in the Other Transactions grid, until the Match Total displays zero. If you can't see a Discount column, contact your administrator.

Set of terms used to determine due dates and discounts for the goods and services bought or sold. Terms can be set at account level for vendors and/or company level for customers. in force when the document was posted. You can, if you wish, amend the amounts paid and the values of any discounts in the Paid and Discount columns in the Other Transactions grid, until the Match Total displays zero. If you can't see a Discount column, contact your administrator.

For a match that includes values to write off

For a match that includes values to write offWhen you have selected the transactions you want to match, enter the actual amounts paid and the values of any write-offs into the Paid and Write-off columns respectively in the Other Transactions grid, until the match total displays zero. If you can't see a Write-off column, contact your administrator.

Committing a Match

When you reach a Match Total of 0.00, click Commit. See About Cash Matching for more information about what happens when you commit a match.

If successful, the header details are displayed along with a new cash matching reference.

- To continue matching the same account, click Retrieve again.

- To continue matching a different account, edit the Account field before clicking Retrieve.

- To conclude the matching session, choose another tab.