You can set up "Recurring Fixed" contract line items to be charged and billed at different intervals. You do this by specifying a charge term on the contract line item, in addition to a billing term. Charge terms and billing terms both use soft dates. So for example, if you want to charge a contract line item by month but bill it each quarter, you can do this by setting a monthly soft date for the line's charge term and a quarterly soft date for the line's billing term.

When you set a charge term on a contract line item, Billing Central uses it to calculate the line's Total Contract Line Value (provided that the line meets the conditions for TCLV calculation). Discounts are applied per charge term, and proration (if used) is applied to partial charge periods. The values on billing schedules are calculated using the number of charge terms that occur within each schedule. The contract line item's recurring revenue is calculated using the multiplier on the charge term's soft date.

If you do not set a charge term on a contract line item, the line is both charged and billed at the frequency defined by the billing term. Billing Central then uses the billing term to calculate the line's Total Contract Line Value (including discounts and proration), the billing schedule values, and the contract line item's recurring revenue.

Example 1: Charge Monthly and Bill Half Yearly

A customer subscribes to a service for 20 users. The cost is $100 per user per month, and is billed twice a year. When creating the contract line item you set a MB (month beginning) soft date for the charge term, and a HB (half year beginning) soft date for the billing term.

| Quantity | Unit Price |

Sales Price |

Charge Term | Billing Term | Amount Billed per Billing Term = Sales Price * Number of Charge Terms in Billing Term |

|---|---|---|---|---|---|

| 20 | 100 | 2000 | MB | HB | 2000 * 6 = 12000 |

If you give the customer a discount of $100 per month:

| Quantity | Unit Price |

Discount |

Sales Price |

Charge Term | Billing Term | Amount Billed per Billing Term = Sales Price * Number of Charge Terms in Billing Term |

|---|---|---|---|---|---|---|

| 20 | 100 | 100 | 1900 | MB | HB | 1900 * 6 = 11400 |

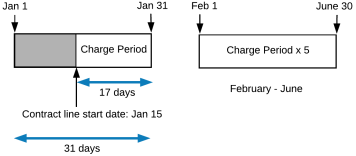

If the first charge period is a partial period, the amount charged for the first charge period will be prorated according to the proration policy assigned to the contract. For example, let's assume that the discounted contract line item above starts on January 15 2022. The MB (month beginning) charge term means that the charge periods will be January 1 - January 31, February 1 - February 28, March 1 - March 31, and so on. If the contract is using Actual Days in Period proration, the amount charged for the first period will be for the 17 of the 31 days in January that the contract line item was in use so the calculation will be 1900 * (17/31) = 1041.94 when rounded to two decimal places. The amount billed for the first half year will be the partial period amount plus five whole periods: 1041.94 + (5 * 1900) = 10541.94

Example 2: Charge Yearly and Bill Quarterly

A customer purchases a training course for 2 employees. The cost is $3000 per person for the year, and is billed in four installments over the year.

| Quantity | Unit Price |

Sales Price |

Charge Term | Billing Term | Amount Billed per Billing Term = Sales Price / Number of Billing Terms in Charge Term |

|---|---|---|---|---|---|

| 2 | 3000 | 6000 | YB | QB | 6000 / 4 = 1500 |

Example 3: How Billing Central Deals with Rounding

When the charge term is greater than the billing term, and the charge period amount does not divide neatly between its billing periods, Billing Central uses cumulative rounding.

For example, a year long contract line item is charged quarterly and billed monthly. The amount charged per quarter is $100. This is divided between three billing periods as shown below.

| Quantity | Unit Price |

Sales Price |

Charge Term | Billing Term | Amount Billed per Billing Term = Sales Price / Number of Billing Terms in Charge Term |

|---|---|---|---|---|---|

| 1 | 100 | 100 | QB | MB | 100 / 3 = 33.333333 |

When you create billing schedules for this contract, Billing Central rounds the value billed for each period and carries over the rounding error to the next period. So for the three billing periods in each quarter, rounding is as follows:

Period 1: $33.333333 rounds to $33.33, carry over $0.003333

Period 2: $33.333333 + 0.003333 = $33.336666 rounds to $33.34, carry over -$0.003333

Period 3: $33.333333 - $0.003333 = $33.330000 rounds to $33.33 with no carry over

The billing schedules and billing documents for the whole year therefore have the following values:

|

Period |

Amount Billed |

|---|---|

| 1 | 33.33 |

| 2 | 33.34 |

| 3 | 33.33 |

| 4 | 33.33 |

| 5 | 33.34 |

| 6 | 33.33 |

| 7 | 33.33 |

| 8 | 33.34 |

| 9 | 33.33 |

| 10 | 33.33 |

| 11 | 33.34 |

| 12 | 33.33 |

If period 1 is a partial period and the amount ($33.333333) is prorated, periods 2 and 3 are still billed as if period 1 was a whole period and the rounding error is carried over. So in the table above, the amounts charged for periods 2 and 3 are unchanged regardless of whether period 1 is prorated.

SECTIONS

SECTIONS