When using the Assume 30 Days per Month proration calculation, the proportion invoiced for the partial period is based on the number of days used out of the full charge period, but each month is assumed to have 30 days.

The formula used to calculate the prorated value for the partial period is:

Sales Price * (x/y)

where x and y are calculated under the assumption that all months have 30 days:

- x is the number of days that the contract has been in use, including start and end days, during the partial period

- y is the number of days in the full period

If the charge term is monthly, a period is assumed to have 30 days. If the charge term is quarterly, a period is assumed to have 90 days. If the charge term is yearly, a period is assumed to have 360 days.

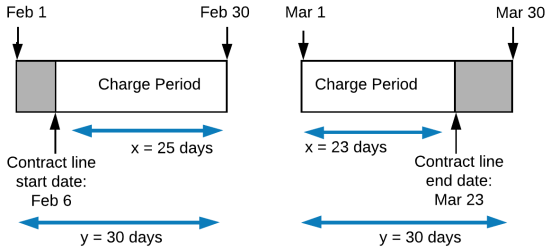

The following examples show how prorated values are calculated when using the Assume 30 Days per Month calculation method. Remember that each month is assumed to have 30 days even though in reality a month might have 28, 29, 30 or 31 days.

Example 1

This example illustrates how although February has 28 days in 2017, and March has 31 days, both months are assumed to have 30 days.

|

Line Start Date |

Line End Date |

Charge Term |

Line Sales Price |

First Charge Period |

Final Charge Period |

|---|---|---|---|---|---|

| Mon, Feb 6, 2017 | Thurs, Mar 23, 2017 | MB | $100 |

Feb 6 to Feb 30 = 25 days Feb 1 to Feb 30 = 30 days $100 * (25/30) = $83.33 |

Mar 1 to Mar 23 = 23 days Mar 1 to Mar 30 = 30 days $100 * (23/30) = $76.67 |

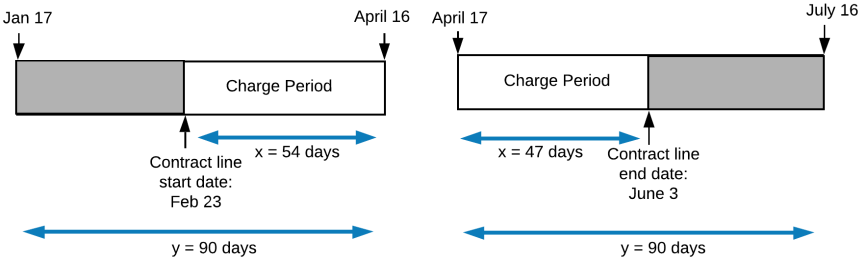

Example 2

|

Line Start Date |

Line End Date |

Charge Term |

Line Sales Price |

First Charge Period |

Final Charge Period |

|---|---|---|---|---|---|

| Thurs, Feb 23, 2017 | Sat, June 3, 2017 | QB + 16d | $378 |

Feb 23 to April 16 = 54 days Jan 17 to April 16 = 90 days $378 * (54/90) = $226.80 |

April 17 to June 3 = 47 days April 17 to July 16 = 90 days $378 * (47/90) = $197.40 |

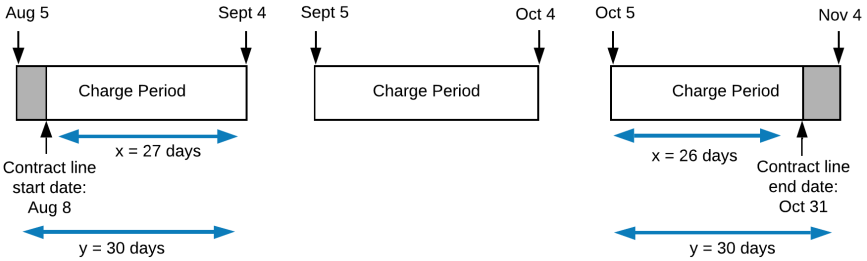

Example 3

Compare this to Example 3 in Calculating Actual Day Proration where the same scenario is used.

|

Line Start Date |

Line End Date |

Charge Term |

Line Sales Price |

First Charge Period |

Final Charge Period |

|---|---|---|---|---|---|

| Tues, Aug 8, 2017 | Tues, Oct 31, 2017 | MB + 4d | $930 |

Aug 8 to Sept 4 = 27 days Aug 5 to Sept 4 = 30 days $930 * (27/30) = $837 |

Oct 5 to Oct 31 = 26 days Oct 5 to Nov 4 = 30 days $930 * (26/30) = $806 |

SECTIONS

SECTIONS