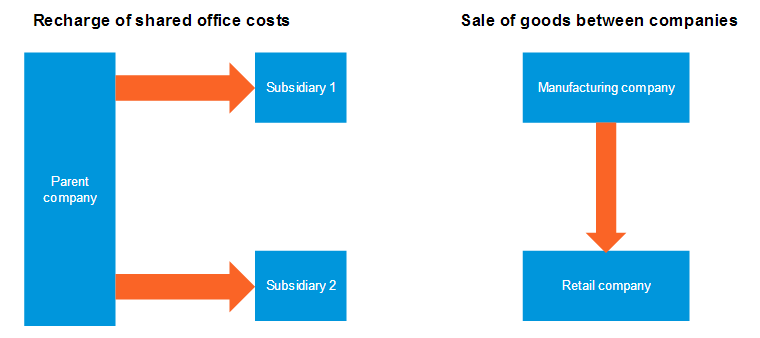

FinancialForce Accounting supports intercompany sales transactions such as these:

This is a four-step process:

In the source company:

- Create an intercompany sales invoice. See Creating and Posting an Intercompany Sales Invoice for more details.

- Post the intercompany sales invoice. In addition to posting the normal transaction, this creates the appropriate intercompany transfer record.

Then, in the destination company:

- Process selected intercompany transfers to generate corresponding payable documents. See Processing Intercompany Transfers for more details. This step might happen automatically if the source company's intercompany definition is set up to auto-process.

- Post the payable document. This step might happen automatically if the destination company's intercompany definition is set up to auto-post.

When creating a payable invoice in the destination company, the following data is derived from the sales invoice header:

- Invoice Number > Vendor Invoice Number

- Invoice Date > Invoice Date

- Invoice Currency > Invoice Currency

- Invoice Total > Vendor Invoice Total

- Customer Reference > Reference 1

- Invoice Description > Invoice Description

- Withholding Tax > Withholding Tax

- Withholding Rate > Withholding Rate

The due date is derived from the invoice date and the vendor account's credit terms Set of terms used to determine due dates and discounts for the goods and services bought or sold. Terms can be set at account level for vendors and/or company level for customers..

Set of terms used to determine due dates and discounts for the goods and services bought or sold. Terms can be set at account level for vendors and/or company level for customers..

When creating the payable invoice lines, all lines are of type "Product" and the following data is derived from the sales invoice lines:

- Product > Product

- Quantity > Quantity

- Unit Price > Unit Price

- Line Description > Line Description

- Exclude from Withholding > Exclude from Withholding

Tax codes are not copied from the sales invoice. Instead, tax codes and rates are derived in the normal way for a payable invoice.

The Handling of Tax Rules

When you look at the tax rules in an intercompany scenario, it's important to think of them from the point of view of the company that owns the document. For example, if Merlin Auto USA (SUT company type) is billing Merlin Auto GB (VAT company type) then the sales invoice in Merlin Auto USA will follow the SUT tax rules and the corresponding payable invoice in Merlin Auto GB will follow the VAT tax rules. You must ensure that each intercompany account is correctly configured for the relevant tax rules.

See About Tax for more information.

The Handling of Analysis Dimensions

Sales invoices and credit notes:

- If the account is an intercompany one and default dimensions exist on the intercompany definition, then these dimensions will be used on the account line of the transaction in the source company.

- If the dimensions are blank on the intercompany definition, the dimensions on the account are used instead (if present and the related Copy Account Values checkbox is set).

Payable invoices and credit notes:

- If the account is an intercompany one and default dimensions exist on the intercompany definition, then these dimensions will be used on the account line of the transaction in the destination company.

- If the dimensions are blank on the intercompany definition, the dimensions on the account are used (if present and the related Copy Account Values checkbox is set).

In both cases, you can enter or amend the dimensions on the billing document as they do not override the dimensions in the intercompany definition.

The Handling of Processing Errors

If the intercompany transfer process fails the user who ran it will receive an email message with reasons for the failure. This information is also stored on the related intercompany transfer record. See Processing Intercompany Transfers for information on how to resolve processing errors.

Here are some possible reasons that the process might fail:

- The accounting currency doesn't exist in the destination company. You must create this accounting currency in the destination company.

- The sending company hasn't got a related account. See About Intercompany Accounts for more information.

- The Vendor Invoice Number (or Vendor Credit Note Number) already exists or is not populated. See the custom settings relating to vendor document number validation in Managing Custom Settings for more information.

- The payable invoice total doesn't match the sales invoice total. This may occur if the two companies operate under a VAT/GST tax regime and is likely to be caused by differences in the tax treatment of the two documents. This could be because the product's output VAT rate and its input VAT rate are different. You must amend the tax code on either the account or the product to one that uses the same rate as the output VAT code. See About Tax for more information on how the tax codes are derived.